Hacking on my finances

Currently, my job has taken a lot of my time. But who doesn't have time for side projects? At the end of the day - they keep us sane. So I’ve been currently hacking on a good way of managing my finances - and oh boy I’m having fun.

Update: Part 2: Beancount on Beanstalk

You can ready the whole story, or just jump to my current setup.

But why do you even bother?

I’ve been keeping track of my finances for about 10 years now. No it’s not something you should absolutely do, but being raised in a household where this was the norm, I’ve naturally found myself doing it from a “young age”.

Of course there are many reasons to track your finances, but for me, the question is pretty simple: I just want to have the power to understand where my money goes, and where my money comes from. And since “information is power”, I’ve been a bit obsessed with documenting.

How I have tracked my finances in the past

Like every “tracking aficionado”, I started tracking all of my finances using mobile applications. I’ve used everything from DailyCost to Spending Tracker. But all of these had drawbacks. Not because of the apps themselves, but because they did not fit my mindset/workflow. I want to know how much I have on account X, and how much I owe to someone next month. And even though some modern alternatives already connect to your bank accounts, I wanted something more “hackable”.

And so I fell into “Excel hell”. I found that I could use a simple app to track my spendings (Spendee) and then, at regular intervals I would put that information into Excel. There, I would create my own overview of “how things are going”, and “where my money was spent”.

But keeping track of things in Excel had various drawbacks:

- I had no connection to my banking accounts

- Currency exchanges are a pain in the ass (I know there are plugins, but come on..)

- I had to create a lot of custom formulas, that were a pain to maintain

- Excel is proprietary software, and I don’t like depending on proprietary software

- The system was not programmable to my needs - hard to extend

So after 7 years tracking my finances in Excel - I decided to look for something better (for me at least)

Enter plain text accounting

Plain text accounting is a movement, or even better, a community. It’s a group of people passionate about keeping track of their finances using plain text formats, programmable interfaces, and hackable workflows.

Imagine having a txt file where you can manage all of your finances - and hack in workflows that fit your needs exactly. That sounded just like the solution I needed.

Upon further investigation of command line applications (because who likes GUIs?) that are inline with plain text accounting, I found beancount. There are also other alternatives such as Ledger (written in C++) or hledger (written in Haskell).

But hey, I’m a Python guy, and want to be able to hack on this to my needs, so I went with beancount.

So how do I manage my finances now?

Disclaimer: This is how I do it - your current situation and preferences will most likely be very different from mine - so this is by no means a tutorial - simply a showcase

Out and about

At the end of the month, I like to be able to look back and see how much I have spent in different categories such as “Entertainment”, “Groceries”, “Shopping” etc. So when I’m out in about, I usually use Spendee to keep track of those. Spendee has a whole world of other features - but I simply use it for tracking simple transactions.

The central piece: Beancount

The whole overview of my finances, uses beancount. I’m not going to go deep on how awesome beancount is, or the whole feature set that it offers. (for that you can start with the incredible documentation)

It basically takes a “beacount file” and allows you to generate several reports / consistency checks/ queries on that same file.

Here’s an example of a beancount file:

; creating an account and setting some balances

2015-01-01 * "Opening Balance for checking account"

Assets:US:BofA:Checking 3490.52 USD

Equity:Opening-Balances -3490.52 USD

; an example expense

2017-04-18 * "Verizon Wireless" ""

Assets:US:BofA:Checking -85.18 USD

Expenses:Home:Phone 85.18 USD

; another example expense

2017-04-23 * "Wine-Tarner Cable" ""

Assets:US:BofA:Checking -80.20 USD

Expenses:Home:Internet 80.20 USD

So every month, I take my spendings, input them into my beancount file, make sure my accounts and assets all match, and basically do my “bookkeeping” on that file. For this, I use a system called “Double entry counting” (learn more here).

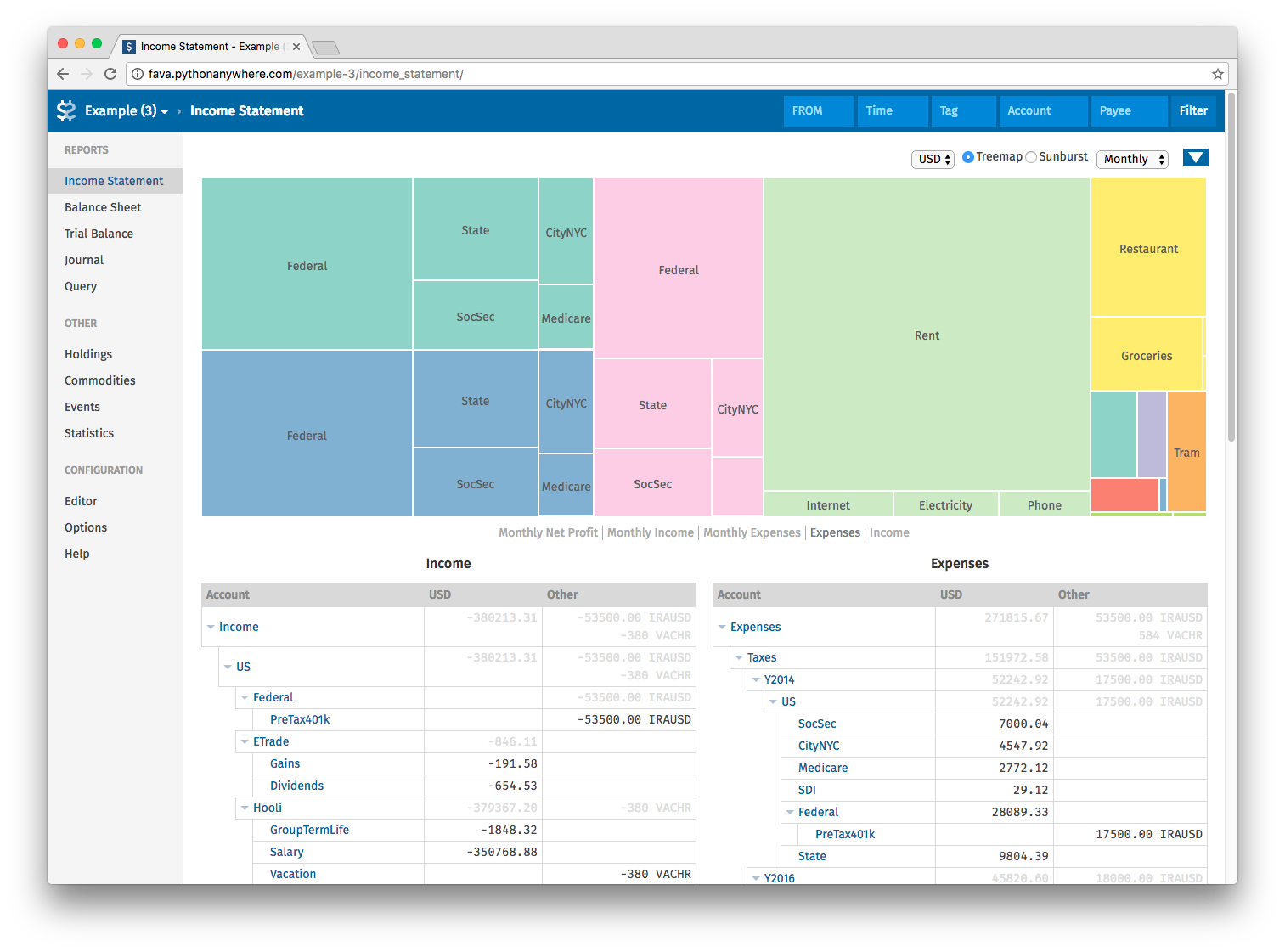

Analyzing everything: Fava

Even though beancount can generate some reports, I have found that the terminal is not the best place to analyze data.

Fortunately, Fava exists. Fava is a web interface for your beancount file. It allows you to have a nice to use, easy to navigate website, where you can:

- Have an overview of your accounts

- Run queries on your transactions (Using the beanquery language)

- Visualize your data in different times/accounts/categories

Access from anywhere

To make sure I can access my beancount files anywhere, I have kept all of them synced to a nice git repo that syncs with my server.

I have also installed Fava on that server, which basically allows me to access my visualizations in any machine that has a web browser.

And oh boy do I love this setup.

Closing thoughts

I’m still improving on this setup - creating custom scripts that evaluate my position given my constraints, automatically connect to my assets, and even alarm me if something not expected happened.

And that’s the beauty of not using Excel. I’m now using something I can hack on and make my own - and even though that’s not a complete system - it’s a great system for me.

Thanks to Martin Blais for creating beancount and for actively maintaining and documenting such an awesome tool.

Update: This post has been featured in the awesome plain text accounting blog.